Attorney Brittany Hinojosa Citron Discusses National Estate Planning Awareness Week – Special Announcements and Upcoming Seminar, for this week’s Smart Counsel for Lunch. Please watch and if you have any questions or want to learn more please call us at 781 461-1020.

Articles and Blogs

Estate Planning for Young Families – Nov 6th – in person seminar!

Learn about probate, guardians, and what you can do to prepare. 📢 Join us for an exclusive seminar about Estate Planning for Young Families hosted by Attorney Leah Kofos right here in the office at SSB. Learn about probate, guardians, and what you can do to prepare. ✨ 📅 November 6, 2025 🕓 6:00 pm📍 Samuel, Sayward & Baler, 858 Washington Street, Suite 202, Dedham, MA Seats are limited – sign up today!

https://www.eventbrite.com/e/estate-planning-for-young-families-tickets-1804349400629

In Good Hands: What to Consider When Naming Fiduciaries

Selecting the people who will act on your behalf when you can no longer do so is one of the most personal and consequential choices you’ll ever make. Whether you are thinking about who to name in your Health Care Proxy, Power of Attorney, Will, or Trust, each decision involves more than simply identifying someone you care about. These roles demand individuals who are capable, trustworthy, and aligned with your values. They will be your voice and steward when you are unable to speak or act for yourself, so careful consideration is essential.

What Makes a Good Fiduciary

At the heart of every fiduciary role is trustworthiness. A fiduciary must act solely in your best interest, without personal gain or bias. This means choosing someone who has demonstrated honesty and reliability in past situations – someone whose word and actions you can count on.

Equally important is organization. Fiduciaries often juggle complicated tasks – handling bank accounts, communicating with lawyers, filing taxes, or making medical decisions. A person who keeps careful records, pays attention to deadlines, and can manage details under pressure is far better suited to these responsibilities than someone who is easily overwhelmed.

Of course, each role necessitates its own consideration when choosing fiduciaries. For example, when choosing who to name in your Health Care Proxy, compassion and composure are essential. A good health care agent will remain calm in a medical crisis, ask the right questions, and make informed decisions with empathy and clarity. The attorney-in-fact named in your Power of Attorney or your Trustee in your Trust, should have good organization skills, attention to detail, and financial literacy. The person doesn’t need to work in the finance field, but they should be comfortable reviewing statements, understanding basic financial principles, and consulting professionals when needed.

Across all these roles, certain qualities rise to the top: organization, honesty, reliability, and good judgment. Yet perhaps the most important trait of all is familiarity with you – the way you think, what you value, and what kind of legacy you want to leave. A fiduciary who knows you deeply is more likely to make choices that reflect your character, even in situations you could not have predicted.

It’s also worth remembering that these appointments are not set in stone. Life changes, and so do relationships. Review your designations every few years, or after major life events, to ensure they still make sense. Discuss your decisions openly with those you appoint so they understand the scope of their responsibilities and the spirit behind them.

Common Mistakes When Choosing Fiduciaries

Despite good intentions, many people make avoidable errors when naming fiduciaries. One of the most frequent mistakes is choosing based on emotion rather than capability. It’s natural to want to appoint a spouse, child, or close friend, but not everyone has the skills or temperament for the role. Affection should be balanced with practical assessment.

Choosing a fiduciary based solely on the birth order of your adult children is another common pitfall. The oldest child may not have the organizational skills, temperament, or availability needed to manage complex financial or legal responsibilities. Age does not necessarily equal capability or good judgment.

Another misstep is failing to discuss the role in advance. A fiduciary who is unaware of their appointment – or unclear about what’s expected – may decline when the time comes, leaving your plans in limbo. Having an open conversation ensures they understand your wishes and are comfortable accepting the responsibility.

Sometimes people overlook potential conflicts among family members when choosing fiduciaries. Naming one child as power of attorney or executor can lead to resentment or disputes among siblings. In families where tensions already exist, a neutral or professional fiduciary may better preserve relationships and ensure fairness. Similarly, naming co-fiduciaries who don’t get along can cause major problems down the road – so much so that some institutions often do not accept co-fiduciaries.

Making Thoughtful Choices

Choosing fiduciaries is ultimately an act of trust. You are entrusting someone to stand in your place when you cannot, to act not only with authority but with heart. By selecting individuals who combine integrity with understanding – people who are both capable and who truly know you – you ensure that your health, your finances, and your legacy are carried forward exactly as you intended.

Attorney Leah A. Kofos is an attorney with the Dedham firm of Samuel, Sayward & Baler LLC, which focuses on advising its clients in the areas of trust and estate planning, estate settlement, and elder law matters. This article is not intended to provide legal advice or create or imply an attorney-client relationship. No information contained herein is a substitute for a personal consultation with an attorney. For more information visit ssbllc.com or call 781-461-1020.

© 2025 Samuel, Sayward & Baler LLC

What is Probate?

Attorney Sean Downing discusses What is Probate? on our Smart Counsel for Lunch Series. Please watch and if you have any questions or want to learn more please call us at 781 461-1020.

Five Things To Do When a Loved One Passes Away

Dealing with the death of a loved one is a challenging and emotional process. Whether the passing was expected or unexpected, managing their affairs can be difficult to think about while dealing with the grief and loss of a loved one, and you may need guidance throughout the process. Here are five things you should consider doing after a loved one’s death:

1. Arrange Burial and Memorial Services According to the Loved One’s Wishes

If the deceased was forward-thinking enough to pre-arrange and/or pre-pay their funeral when also preparing their estate plan, then contact the funeral home with which these arrangements were made. If no plan was put in place before death, contact a reputable funeral home to guide you through the burial and memorial service process.

As part of an estate plan, the deceased may have prepared a Directive as to Remains. A Directive as to Remains is a document that instructs the deceased’s Personal Representative (the person named in the Will who is responsible for administering the estate) to arrange the deceased’s burial or cremation and funeral/memorial services as directed in that document. Your loved one alternatively may have written down similar wishes in a letter of instruction. Carefully review your loved one’s estate planning documents to learn if the deceased left such instructions so that his or her wishes are carried out.

2. Find and Organize Important Documents

Hopefully your loved one showed you where they keep important documents like their Will, income tax returns, financial account statements, and bills that are regularly paid. This information will be necessary for settling and administering the deceased’s estate. Look for these documents and gather as much information as you can.

If the deceased named you as the Personal Representative of their estate, then you will need death certificates for the deceased. You should obtain about 5 to 10 death certificates to provide to financial institutions, life insurance companies, and the court if probate is necessary.

Locate a safe but easily accessible place where you can store this information as you will refer to and use it often. Do not throw away any financial records or legal documents until you know you will not need them for tax filings, asset valuation, or other purposes.

3. Secure Property of the Estate

Your loved one may have several different types of assets in their estate at death. In every case, the Personal Representative (or Trustee if there is a Trust) is responsible for ensuring the deceased’s property is secure and protected for the beneficiaries of the estate. For example, it is important to safely store valuable jewelry and artwork. Similarly, any real estate should be securely locked (perhaps even change the locks) and regularly visited to ensure the real estate and the deceased’s personal belongings are secure. In fact, it is an obligation of the Personal Representative to do so, and they may be liable if such measures are not taken and damage occurs to the property. The Personal Representative should also maintain or obtain insurance in connection with the deceased’s assets, as necessary, and may need to have some or all of them appraised for estate administration and/or estate tax purposes.

4. Contact an Estate Planning and Administration Attorney

The settlement of an estate can be incredibly complex depending on the assets and beneficiaries involved, and the provisions of the deceased’s estate plan. The Personal Representative should contact an attorney to guide and assist them through the process of completing and filing the required documents to be appointed as Personal Representative by the probate court, gathering assets, paying appropriate expenses, and making distributions, to avoid failing to fulfill their obligations. This is especially important if the estate assets are valued at over $2 million and a Massachusetts estate tax will be payable, or if it is anticipated that MassHealth (Medicaid) may file a claim against the estate to be reimbursed for any MassHealth benefits (for home care or nursing home care) received by the deceased during their lifetime.

Keep in mind that the administration of an estate typically takes at least one year, so you may want to take the tortoise’s point of view – slow and steady wins the race. You want to be thorough and properly navigate the legal and financial aspects associated with administering the estate.

5. Communicate and Work Together

On top of the issues mentioned above, estate administration can be made more difficult if there are strained relationships between the beneficiaries, which often also includes the person who is serving as Personal Representative. Perhaps there is a history of family disharmony. Perhaps multiple beneficiaries are sentimentally attached to mom’s diamond engagement ring and they must decide who gets to keep it. The only person who wins when there are disagreements between beneficiaries that cannot be resolved is the attorney who gets paid to resolve them via negotiation or court action. Instead, consider embracing the three C’s as much as possible when working with each other: Communication, Cooperation and Compromise. Try offering support to each other during this difficult time.

Estate administration can be a juggling act where the Personal Representative is managing several different responsibilities all at once, including fulfilling the wishes of the deceased and the Personal Representative’s obligations to the beneficiaries. An estate planning attorney knowledgeable in the process of estate administration can guide you through that process in a correct and efficient manner so that you have peace of mind when all is complete—hopefully with family relationships intact, which is most likely what your loved one would have wanted when setting up their estate plan.

Attorney Brittany Hinojosa Citron is a senior associate attorney at Samuel, Sayward & Baler LLC which focuses on advising its clients in the areas of estate planning, estate settlement and trust administration. This article is not intended to provide legal advice or create or imply an attorney-client relationship. No information contained herein is a substitute for a personal consultation with an attorney. For more information or to schedule a consultation with one of our attorneys, please call 781-461-1020.

October 2025

© 2025 Samuel, Sayward & Baler LLC

Attorney Sean Downing’s Smart Counsel Interview with Chelsea Lanson from HESSCO

This week we feature Attorney Sean Downing’s Smart Counsel interview with Chelsea Lanson from HESSCO. Sean and Chelsea discuss HESSCO’s services.

HESSCO is the Aging Services Access Point (ASAP) and Area Agency on Aging (AAA) for South Norfolk County in Massachusetts, HESSCO’s mission is to help older adults and individuals living with a disability remain safe and independent at home for as long as possible.

Learn more: https://hessco.org/

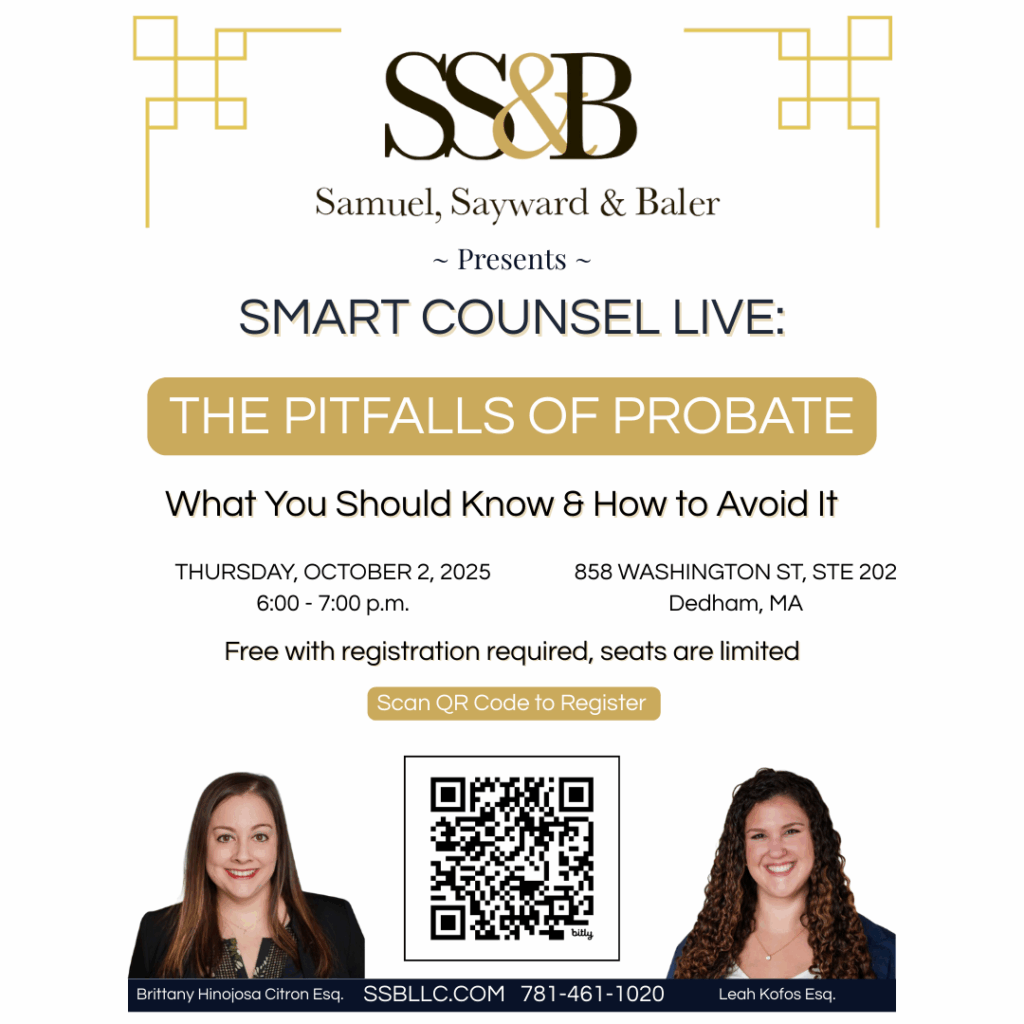

Smart Counsel LIVE!: In-Person Seminar on the Pitfalls of Probate

Join us for an exclusive seminar on the Pitfalls of Probate hosted by Attorneys Brittany Hinojosa Citron and Leah Kofos right here in the office at SSB. Learn what probate really means, how it works, and what you can do to prepare. Seats are limited – sign up today!

October 2, 2025 6:00 pm Samuel, Sayward & Baler, 858 Washington Street, Suite 202, Dedham, MA.

Lawyers Are Expensive – So Why Do I Need One?

It’s no secret: lawyers can be costly. So it’s understandable that many people wonder if they really need one – especially when it comes to estate planning, probate, or administering a trust after someone dies. But here’s the reality: while lawyers may seem expensive upfront, the right lawyer can save you time, stress, and potentially much more money down the line.

If you’ve been named as a Personal Representative of a Will or Trustee of a Trust, you’ve been placed in a fiduciary role – which means that you’re legally obligated to act in the best interest of someone else. It’s not just a matter of paying some bills and distributing assets. You have real legal responsibilities and can be personally liable for mistakes.

Common pitfalls include:

- Misinterpreting the terms of a trust or will

- Missing important deadlines for tax filings or creditor notifications

- Failing to properly account for funds

- Making distributions too early, or in the wrong amounts

- Mishandling assets or overlooking the need for court filings

Even innocent errors can result in disputes with beneficiaries or, worse, lawsuits. A skilled attorney helps you avoid these risks, providing clear guidance tailored to your specific duties and the laws of your state.

So how do you choose a lawyer?

Not all lawyers are created equal. Many attorneys market themselves as estate planners, focusing on drafting wills, trusts, and other planning documents. That’s an essential skillset — but not the only one you should look for.

If you’re choosing someone to help create your estate plan (or to guide you in a fiduciary role), look for an attorney who also handles estate and trust administration. Why? Because they bring a practical, experience-based perspective to the process.

An attorney who has seen how trusts and estates play out after death will draft better documents during life. They’ll know which provisions cause confusion, which funding methods lead to delays, and how to structure things to make life easier for your future Personal Representative or Trustee. They won’t just give you a binder full of documents — they’ll give you a roadmap to making it all work.

This insight can be the difference between an orderly, efficient estate process and one bogged down in costly delays, court involvement, or family conflict.

Legal documents often look good on paper. But the true test of an estate plan is how it functions in real life. An experienced attorney brings something critical to the table: the ability to distinguish between what’s technically legal and what actually works.

Let’s be honest: experienced lawyers aren’t cheap. But there’s a reason for that. You’re not just paying for documents or court filings – you’re paying for peace of mind.

A well-qualified attorney not only ensures that your documents are legally sound and tailored to your goals, but also that your Trust is properly funded, your fiduciary responsibilities are clearly defined and as easy as possible to carry out, and that potential risks are identified and addressed before they become costly issues. In essence, the right lawyer prevents a situation in which your loved ones are left to “just figure it out” after you’re gone.

If you’re taking on the responsibility of a fiduciary – or planning your own estate – investing in the right legal guidance now can prevent much greater expense (and heartache) later.

Bottom line: You don’t just need a lawyer – you need the right lawyer. One with real-world experience in both planning and administration. One who knows how things go wrong, and how to get them right. One who sees beyond the theory and helps you plan for real life. Yes, it may cost more upfront. But in the long run, it’s one of the best investments you can make – for yourself and for those you care about.

Five Things to Know About the Massachusetts Estate Tax

As the summer ends, the school year begins, and Halloween looms, the fun and games are over and our thoughts turn to two of our favorite topics, death and taxes. As you may know, the federal estate tax law allows you to leave $13.99 million to your heirs estate federal tax free. This federal estate tax “exemption” is scheduled to increase to $15 million on January 1, 2026, and will be indexed for inflation thereafter, allowing a married couple (with proper tax filings at the death of the first spouse to die) to leave a combined $30 million to their heirs free of federal estate tax. However, here in Massachusetts we are one of only twelve states and the District of Columbia that impose a separate state estate tax. If you live in Massachusetts or own real estate here it is understandable why death and taxes may be two of your favorite topics, since there is much to talk about. Here are five things to know about the Massachusetts estate tax.

1. Massachusetts Estate Tax Exemption. The Massachusetts estate tax is a one-time tax due nine months after death and based on the value of the assets owned by the deceased person on the date of their death. The law changed effective January 1, 2023, to increase the Massachusetts estate tax exemption to $2 million. The exemption is the amount you may leave to your heirs without paying any estate tax. Previously, the Massachusetts estate tax exemption stood at $1 million; however, that was more like a cliff than an exemption. If the value of the estate at death was over $1 million in value, the estate was taxed starting at the first dollar of value. With the recent estate tax change, Massachusetts has a true $2 million exemption, which means the estate is taxed only on the amount over $2 million. Massachusetts imposes estate tax based on a graduated rate schedule ranging from 7.2% for estates just over $2 million to 16% for estates over $10 million. For example, if you die with assets of $2.5 million in Massachusetts, the estate tax due would be approximately $39,200. If you die within an estate of $5 million your estate will pay an estate tax of approximately $292,000.

2. Eliminating or Deferring the Estate Tax Due. There are ways to eliminate or defer the estate tax that may be payable at your death. Assets left to charity pass free of estate tax. If you are feeling especially generous and leave your entire estate to a charity, regardless of the value of your estate, there will be no estate tax payable at your death. Most people who are married leave their estate to their spouse, and this will also result in no estate tax payable at the death of the first spouse to die. However, at the death of the surviving spouse, when assets typically pass to children or other family members, an estate tax will be due if the value of the surviving spouse’s estate exceeds $2 million. Certain trusts can be prepared as part of an estate plan that addresses estate tax planning, typically called “credit shelter trusts,” that can shelter a portion of the estate of the first spouse to die in trust for the benefit of the surviving spouse in such a way that those trust assets are not taxed in the surviving spouse’s estate. These types of trusts are commonly used to significantly reduce (if not completely eliminate) the estate tax that will be paid at the surviving spouse’s death, thereby saving taxes for the children or the heirs who inherit the estate after the surviving spouse passes away. There are other types of trusts that can be used to further reduce the estate tax for larger estates.

3. Deathbed Gifts. A discussion of death and taxes would not be complete without a mention of deathbed gifts. In Massachusetts, it is possible to make gifts immediately before death and have those gifts not be considered part of the taxable estate of the gift giver. Therefore, if you have a taxable estate and are in poor health, you might consider making gifts of assets to your heirs prior to your death in order to reduce the estate tax that will be paid after your death. Cash is an excellent asset to give in these circumstances. It is very important to keep in mind two things when making deathbed gifts: (1) if you make a gift of appreciated assets such as real estate or investments, the recipient takes the tax basis of the gift giver, and (2) when a person dies owning appreciated assets under current tax law the tax basis of those assets automatically increases at death to equal the value of the asset on the date of death (the so-called “step-up” in basis), essentially wiping out the unrealized capital gain on those assets. Therefore, in many circumstances, it is more valuable to retain highly appreciated assets until death, even if Massachusetts estate tax may need to be paid on the value of the estate, in order to eliminate the unrealized capital gain and the capital gain tax that would need to be paid if those assets are sold after death, as the capital gain tax is often greater than any estate tax that would be paid.

4. Getting Out of Dodge. Many clever folks think about moving to another state to avoid the Massachusetts estate tax. In a word, this is easier said than done. Many of our fellow New England states also have their own separate state estate tax (Vermont, Maine, Rhode Island, Connecticut). If you are considering a move to the lovely state of New Hampshire, which does not have a separate state estate tax, keep in mind that the Massachusetts Department of Revenue will closely examine your ties to Massachusetts at your death to determine if you were domiciled in this state and are therefore subject to Massachusetts estate tax – even if you claim to live in another state. There are many factors the state looks at, including things like where you file your state income taxes, where your doctors are located, where you vote, where your cars are registered, where you belong to clubs and organizations, and where your bills are mailed. For income tax purposes, the length of time you spent in the other state is important, however for estate tax purposes where you intend to be domiciled is crucial. And if you continue to own real estate in Massachusetts, see consideration #5 below.

5. Non-Residents Owning Massachusetts Real Estate. The recent updates to the Massachusetts estate tax law clarified that if you are Massachusetts resident owning real estate in another state, the value of that out of state is real estate is not includable when calculating the value of your Massachusetts estate on which Massachusetts estate tax is payable. However, if you are an out of state resident owning Massachusetts real estate, you may owe Massachusetts estate tax to the Commonwealth of Massachusetts at your death proportionate to the value that real estate bears to your total estate if the value of your total estate is in excess of the Massachusetts estate tax exemption. Therefore, for those of you intending to keep your house on the Cape and move to New Hampshire to avoid Massachusetts estate tax, be aware that you will not avoid the tax completely even if you successfully change your domicile to New Hampshire. There may be strategies that can be used to change the nature of what you own in order to avoid the estate tax, but this must be done taking into account all the facts and circumstances.

There are so many interesting things to know about the Massachusetts estate tax. Every client’s situation is unique in terms of the value of their assets, the type of assets they own, who their beneficiaries are, how the estate and capital gain tax laws will impact their estate at their death, and whether tax planning is appropriate and advised based on their goals and the nature of their assets. For all of these reasons, it is important to get the advice of an estate planning attorney with experience in estate tax planning if you have assets valued at more than $2 million and you are a Massachusetts resident or own real estate here. If you are interested in doing estate tax planning to reduce your estate tax as much as possible and preserve the maximum amount of your stay for your heirs, please be in touch – we are happy to assist you.

Attorney Leah A. Kofos is an associate attorney with the Dedham firm of Samuel, Sayward & Baler LLC, which focuses on advising its clients in the areas of trust and estate planning, estate settlement, and elder law matters. This article is not intended to provide legal advice or create or imply an attorney-client relationship. No information contained herein is a substitute for a personal consultation with an attorney. For more information visit ssbllc.com or call 781-461-1020.

© 2025 Samuel, Sayward & Baler LLC

The Importance of Incapacity Documents (Health Care Proxy & POA)

Attorney Sean Downing discusses The Importance of Incapacity Documents (Health Care Proxy & POA) for Young Adults, on our Smart Counsel for Lunch Series. Please watch and if you have any questions or want to learn more please call us at 781 461-1020.