By Sarah Newell, CFP® and Steven Joshua Samuel, JD, MBA, AIF®

With average life expectancies increasing, retirees need strategies that address a broad array of uncertainties that arise during retirements that may last three or more decades. Retirees’ top concerns elicited in the 2018 American institute of CPAs (AICPA) Personal Financial Trends Survey included:

77% Health Care Costs

53% Market Fluctuation

50% Other Unexpected Costs

42% Lifestyle Expenses

22% Being a Burden on Relatives

The AICPA survey also reported that CPAs are seeing increases (from five years ago) in the number of clients who experience long term care impact on finances ( 57%), more clients taking care of aging relatives ( 50%); and in the number of clients affected by diminished capacity of a family member ( 45%).

A change in the law in 2020 offers a bit of help to retirees. However, the best approach is still self-help through identifying specific financial goals and developing a comprehensive approach that includes investment strategy, taxes and legal documents. Here are some thoughts about those subjects.

The SECURE Act of 2020

Although legislation alone cannot solve retiree’s major concerns, the SECURE ACT offers some help. The SECURE Act went into effect on January 1, 2020 and makes significant changes to retirement planning. Some of the key changes that affect retirees include:

Age Limit Removed for IRA Contributions

Until 2020, people over 70.5 years of age could no longer contribute to IRA accounts. Beginning in 2020, persons of any age may contribute to an IRA as along that they have income from employment. Note that contributions to company retirement plans have always been permitted by any person eligible for the plan and that remains the law.

Required Minimum Distribution ( RMD) extended to start at age 72

Until 2020, people reaching age 70.5 had to begin withdrawing money from all their retirement accounts. The SECURE act extends the RMD requirement to begin at age 72 for people who had not reached 70.5 before 2020. People who reached 70.5 before 2020 must continue to take RMDs even before age 72.

Incentives are Offered for Small Businesses to Offer Retirement Plans

Elimination of Stretch IRAs

First, a not helpful provision of the SECURE Act requires non-spouse inheritors of IRAs to deplete the entire account within 10 years of inheritance. Previously, all heirs were permitted to stretch withdrawals to the full length of their lifetimes. Second and fortunately, spouses who inherit are permitted to continue to stretch their withdrawals and there are also partial exceptions to the harsh new rule for minor children and persons with disabilities.

The SECURE Act of 2020 makes saving for retirement and tax and estate planning for retirees better in some respects but somewhat more complex. This is a good time to check in with trusted financial and legal advisors. In the meantime, here are some additional thoughts about how successful retirees cope with the uncertainties of retirement.

How Successful Retirees Cope with Retirement’s Uncertainties

Most successful retirees start by carefully identifying their spending goals and developing a reasonably good estimate of their non-discretionary expenses, the basic spending they cannot avoid. Non-discretionary spending means the cost of rent or mortgage and taxes, utilities, transportation costs, meals; and, other lifestyle basics we all seem to have to need, such as our phone and cable. Successful retirees also set some parameters on their discretionary spending on vacations, gifts to family and similar beyond the basics “wants.” Equally important, successful retirees periodically assess potential future expenses such as home and car maintenance and address these with specific savings; and, they address big risks such as health needs with insurance and legal strategies. Of course, successful retirees also accumulate retirement savings and match the level of savings with their level of desired combined total spending, or reduce their spending if the numbers don’t match.

Identifying spending goals and having substantial retirement savings isn’t enough, though. Even substantial savings can be damaged by market losses, especially during retirement, when retirees are withdrawing money for living expenses. Retirees and people saving for retirement must reconcile the need for their investments to grow to keep up with inevitably rising costs versus the need to avoid investment market losses. The fear of failing to successfully reconcile these two goals is made more intense by the memory of the nearly 50% stock market declines in the early 2000s and again in 2008-9.

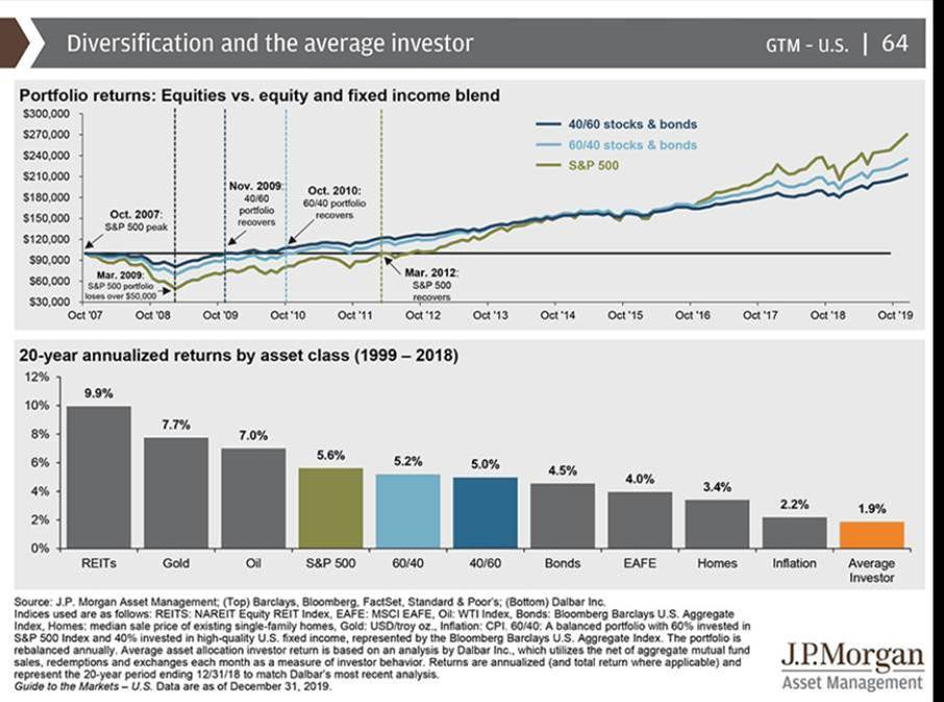

A powerful way some successful retirees reconcile the competing needs for investment growth and avoiding market losses is by regularly revisiting their investment asset allocation. Asset allocation, the ratio of stocks to fixed income in your investments, is an important driver of growth, the engine that can add substantial gains to investment accounts when the market does well. More importantly, asset allocation is a source of protection, when non-stock investments are a sufficient source of funds to avoid the need to sell stock in down times. Although there are many factors that go into deciding the appropriate ratio of stock to fixed income, one way to conceptualize the decision is to think of fixed income (bonds, cash and other lower risk investments) allocation in the context of annual spending needs. For example, if you must withdraw $20,000 per year from your investments, keeping about $100,000 of the overall balance invested in fixed income will support annual withdrawals for 5 years without having to sell from stock if stock prices decline. Five years is as long as it took the US stock market to fully recover to its peak after the Great Recession of 2008-9.

The chart below illustrates the difference in returns between the S&P 500 (the 500 largest US companies), a 60% stock / 40% bond portfolio, and a more conservative 40% stock / 60% bond portfolio. Although the S&P 500 performs well above the more conservative portfolios in good years, it does not recover as quickly in down years. After the trough of the market in October 2008, the 40/60 portfolio recovered only one year later in October 2009, whereas the S&P 500 did not recover until March of 2012 – 3 years behind the 40/60 portfolio. The 20-year annualized return further reinforces this idea by showing us that the annualized return of the S&P 500 over the last 20 years was only 0.40% higher than a 60/40 blend, and only 0.60% higher than a 40/60 blend.

A consistent, thoughtful review of your asset allocation is imperative to preserving assets for a long, prosperous retirement. Is your portfolio positioned to protect your financial future? As always, consult trusted tax and financial professionals before making important tax and financial decisions.

Samuel Financial LLC is located at 858 Washington St. Dedham, MA 02026 and can be reached at (781) 461-6886. Securities and advisory services offered through Commonwealth Financial Network, member FINRA/SIPC, a registered investment adviser. www.samuelfinancial.com.

Fixed insurance products and services offered through CES Insurance Agency or The Hanson Group.