Attorney Suzanne Sayward discusses The Impact of the SECURE Act and the CARES Act on retirement accounts for our Smart Counsel for Lunch Series. Did you know that this year you don’t need to take the minimum distributions. If you have questions or want to learn more please call us at 781 461-1020.

SECURE Act

5 Things to Know about the SECURE Act

What is the SECURE Act?

What is the SECURE Act?

As you may be aware, a new law which significantly changes the way in which inherited retirement assets will be distributed to beneficiaries went into effect on January 1, 2020. This is the SECURE Act. While the SECURE Act includes some beneficial provisions such as increasing the age at which a participant must begin taking required minimum distributions from age 70.5 to age 72 and eliminating age restrictions for contributions to IRAs for individuals who continue to work, the significant downside to the Act is that it will require most beneficiaries of inherited IRAs or 401ks to withdraw all of the funds in the account within 10 years from the owner’s death. This is a big change from the prior rules which permitted distributions over the life-expectancy of the beneficiary. Read on for 5 Things to Know about the SECURE Act (and how it could impact your estate plan.)

- Your beneficiaries will realize less value from the inherited IRA under the SECURE Act. If you were counting on your beneficiaries receiving a certain amount from your estate which includes large IRAs or employer retirement plans, count again. Under the pre-2020 rules, an individual beneficiary could “stretch out” the withdrawal period over which he was required to take distributions over his life expectancy as of the death of the IRA owner. Since the IRS assumes everyone is going to live until age 80 or so, this could mean a very long withdrawal period if your IRA was left to a child or grandchild.

For example, under the pre-2020 rules, a $1 million-dollar IRA inherited by a 50-year old beneficiary could be distributed to the beneficiary over approximately 30 years. This means that in the first year the beneficiary would be required to withdraw about $33,000 from the $1 million IRA and include that amount in his taxable income. The remaining $966,666 that was not withdrawn would continue to grow tax free. Assuming a modest 5% growth, the balance at the end of the year would be $1,015,000. The following year the beneficiary would have to withdraw 1/29th of the balance in the IRA, or about $35,000 from that IRA. Again, the amount that was not withdrawn, about $980,000 would continue to grow tax free during that year and at 5% would be $1,029,000 at the end of the second year, and so on.

Under the SECURE Act rules for inherited IRAs, most beneficiaries will be required to withdraw the entire balance of the IRA within 10 years of the owner’s death. Applying the new rules to the above example means that if the beneficiary withdraws 1/10th of the IRA the first year, she would withdraw $100,000 and pay income tax on that amount. The remaining $900,000 would continue to grow tax free during the year. Assuming a 5% increase, this leaves a balance of $945,000 at the end of that year. If the beneficiary took out 1/10th the second year, that would be a withdrawal of $94,500 leaving a balance of $850,000, and so on.

- There are no changes in the distribution rules for a surviving spouse. While the rules regarding inherited IRAs for most beneficiaries have changed, they have not changed as to a surviving spouse. If you leave your traditional IRA or 401k to your spouse, your spouse will have the option to roll it over into his or her IRA and defer required minimum distributions until age 72. If your spouse is already age 72 or upon reaching age 72, the surviving spouse will be able to take withdrawals over his or her then life expectancy. It is only when the surviving spouse dies and the IRA passes on to the remaining beneficiaries, such as your children, that the 10-year rules come in to play and should be considered in your inheritance planning.

- If your IRA is payable to your Trust it gets more complicated. If you require more complex trust planning or you have structured your estate plan to leave your assets to a Trust for the benefit of your children following your death to provide asset protection for their inheritance or to control the distribution of the funds to them, then this change in the law is even more complicated. The reason for this is that distributions from the IRA are income taxable to the beneficiary. If the beneficiary is a Trust, then the Trust will be responsible for reporting as income the distributions from the IRA and paying the income tax unless the distribution from the IRA is distributed out of the Trust to the beneficiary in the same tax year, in which case the beneficiary will report the income on her income tax return and pay the tax. The problem is that the income tax rates on Trusts are much higher than on individuals. An individual taxpayer reaches the highest federal taxable rate of 37% when she has taxable income of approximately $510,000. A Trust reaches that highest taxable rate when it has income of about $13,000. Since no one wants to pay more tax than is necessary, logic dictates that the distribution from the IRA be distributed out of the Trust to the individual beneficiary. However, once the funds are distributed to the beneficiary, the money is subject to the easy reach of the beneficiary’s creditors such as a divorcing spouse, a bankruptcy, a lawsuit or other creditors. In addition, funds distributed out to the Trust to the beneficiary may be spent as the beneficiary pleases which may not be in accordance with your estate plan goals.

- IRAs passing to minor children may be paid out over the child’s life expectancy, but this comes with a price. Under the SECURE Act, if your IRA passes to your minor child, then the distribution can be stretched out over the minor’s life expectancy during the child’s minority. (Note that the special stretch out rules for minors apply ONLY to the minor children of the IRA owner; they do not apply to step-children, grandchildren, or nieces and nephews). Once the child reaches the age of majority, the 10-year rule applies. There are many challenges associated with this new rule. For example, a minor should never be designated as the direct beneficiary of an IRA. Aside from the fact that most people don’t feel comfortable having assets pass into the hands of a young beneficiary, if a minor is named as the beneficiary of an IRA, then a court proceeding called a Conservatorship will be required. This is expensive and time consuming and best avoided. The best practice is to leave an IRA to a minor beneficiary via a Trust. In order for a Trust to be eligible for the life expectancy payout for a minor under the new rules, the Trust must direct that the required minimum distributions be distributed out of the Trust to the minor beneficiary immediately. This may not be such a big deal while the beneficiary is a minor and the minimum distributions are calculated based on his then life expectancy. Further, the minor would have a guardian who will receive and apply the funds for his benefit. However, once the beneficiary reaches the age of majority (which, by the way, under the SECURE Act could be any time between the ages of 18 and 26), requiring that the IRA distributions be distributed out of the Trust and into the hands of the beneficiary could be a significant problem.

For example, if a $1 million IRA is left to a Trust for the benefit of a minor child who is 10 years old at the death of the parent, then the required minimum distribution the first year would be about $14,300. This amount would have to be distributed out of the IRA to the Trust and then out of the Trust to the beneficiary, or his guardian. Because of the small amount that must be distributed during the beneficiary’s minority, the balance in the IRA is likely to be $1.3 million or more when the beneficiary reaches the age of majority. At that point, the balance in the IRA must be distributed to the beneficiary within 10 years. The Trustee will have the difficult task of deciding on the timing of the withdrawals from the IRA. Is it better to give an 18-year old $130,000 each year for 10 years, or should the Trustee defer taking withdrawals from the IRA until the beneficiary is older, and hopefully wiser, even if doing so will mean a larger tax liability? These are hard decisions and will need to made on a case by case basis. Given the requirement that IRA distributions be distributed out of the Trust to the beneficiary in order to obtain the stretch-out during the child’s minority, parents with large retirement assets may choose to forgo the stretch-out in favor of granting the Trustee discretion to retain withdrawals from retirement accounts in the Trust.

- If you have a Roth IRA, this change is actually beneficial. Under the old rules, inherited IRAs, including Roth IRAs, had to be paid out either within 5 years of the owner’s passing, or over the life expectancy of the beneficiary. The life expectancy option was almost always the best choice as it minimized the taxes and maximized tax-free growth. However, the life-expectancy withdrawal method required that every year beginning with the year after the death of the IRA owner, the required minimum distribution calculated on the beneficiary’s then life expectancy be distributed out of the IRA to the beneficiary. Under the new 10-year rule, the entire amount of the IRA must be distributed by the end of the 10th year following the death of the owner; however, a beneficiary is not required to take the distributions in equal installments. Since distributions from a Roth IRA are not income taxable to the beneficiary, a person who inherits a Roth IRA under the SECURE Act can refrain from taking any distributions for 10 years and allow the value of the Roth IRA to grow tax-free for that 10-year period. After 10 years, the beneficiary will be required to withdraw the entire balance from the Roth but the amount withdrawn is not taxable income to the beneficiary since distributions from a Roth are income tax free.

The bottom line is that everyone who has significant retirement assets should review their estate plan with an experienced estate planning attorney who is familiar with the provisions of the SECURE Act, to understand the impact the Act will have on the distribution of these assets to their beneficiaries. We are happy to review this with you and encourage you to be in touch to schedule a time to meet with one of our attorneys to evaluate how the enactment of the SECURE Act will affect your family and your estate plan.

Attorney Suzanne R. Sayward is a partner with the Dedham firm of Samuel, Sayward & Baler LLC which focuses on advising its clients in the areas of estate planning, estate settlement and elder law matters. She is certified as an Elder Law Attorney by the National Elder Law Foundation, a private organization whose standards for certification are not regulated by the Commonwealth of Massachusetts. This article is not intended to provide legal advice or create or imply an attorney-client relationship. No information contained herein is a substitute for a personal consultation with an attorney. For more information visit www.ssbllc.com or call 781/461-1020.

Febraury, 2020

© 2020 Samuel, Sayward & Baler LLC

How Successful Retirees Cope with Retirement’s Biggest Uncertainties

By Sarah Newell, CFP® and Steven Joshua Samuel, JD, MBA, AIF®

With average life expectancies increasing, retirees need strategies that address a broad array of uncertainties that arise during retirements that may last three or more decades. Retirees’ top concerns elicited in the 2018 American institute of CPAs (AICPA) Personal Financial Trends Survey included:

77% Health Care Costs

53% Market Fluctuation

50% Other Unexpected Costs

42% Lifestyle Expenses

22% Being a Burden on Relatives

The AICPA survey also reported that CPAs are seeing increases (from five years ago) in the number of clients who experience long term care impact on finances ( 57%), more clients taking care of aging relatives ( 50%); and in the number of clients affected by diminished capacity of a family member ( 45%).

A change in the law in 2020 offers a bit of help to retirees. However, the best approach is still self-help through identifying specific financial goals and developing a comprehensive approach that includes investment strategy, taxes and legal documents. Here are some thoughts about those subjects.

The SECURE Act of 2020

Although legislation alone cannot solve retiree’s major concerns, the SECURE ACT offers some help. The SECURE Act went into effect on January 1, 2020 and makes significant changes to retirement planning. Some of the key changes that affect retirees include:

Age Limit Removed for IRA Contributions

Until 2020, people over 70.5 years of age could no longer contribute to IRA accounts. Beginning in 2020, persons of any age may contribute to an IRA as along that they have income from employment. Note that contributions to company retirement plans have always been permitted by any person eligible for the plan and that remains the law.

Required Minimum Distribution ( RMD) extended to start at age 72

Until 2020, people reaching age 70.5 had to begin withdrawing money from all their retirement accounts. The SECURE act extends the RMD requirement to begin at age 72 for people who had not reached 70.5 before 2020. People who reached 70.5 before 2020 must continue to take RMDs even before age 72.

Incentives are Offered for Small Businesses to Offer Retirement Plans

Elimination of Stretch IRAs

First, a not helpful provision of the SECURE Act requires non-spouse inheritors of IRAs to deplete the entire account within 10 years of inheritance. Previously, all heirs were permitted to stretch withdrawals to the full length of their lifetimes. Second and fortunately, spouses who inherit are permitted to continue to stretch their withdrawals and there are also partial exceptions to the harsh new rule for minor children and persons with disabilities.

The SECURE Act of 2020 makes saving for retirement and tax and estate planning for retirees better in some respects but somewhat more complex. This is a good time to check in with trusted financial and legal advisors. In the meantime, here are some additional thoughts about how successful retirees cope with the uncertainties of retirement.

How Successful Retirees Cope with Retirement’s Uncertainties

Most successful retirees start by carefully identifying their spending goals and developing a reasonably good estimate of their non-discretionary expenses, the basic spending they cannot avoid. Non-discretionary spending means the cost of rent or mortgage and taxes, utilities, transportation costs, meals; and, other lifestyle basics we all seem to have to need, such as our phone and cable. Successful retirees also set some parameters on their discretionary spending on vacations, gifts to family and similar beyond the basics “wants.” Equally important, successful retirees periodically assess potential future expenses such as home and car maintenance and address these with specific savings; and, they address big risks such as health needs with insurance and legal strategies. Of course, successful retirees also accumulate retirement savings and match the level of savings with their level of desired combined total spending, or reduce their spending if the numbers don’t match.

Identifying spending goals and having substantial retirement savings isn’t enough, though. Even substantial savings can be damaged by market losses, especially during retirement, when retirees are withdrawing money for living expenses. Retirees and people saving for retirement must reconcile the need for their investments to grow to keep up with inevitably rising costs versus the need to avoid investment market losses. The fear of failing to successfully reconcile these two goals is made more intense by the memory of the nearly 50% stock market declines in the early 2000s and again in 2008-9.

A powerful way some successful retirees reconcile the competing needs for investment growth and avoiding market losses is by regularly revisiting their investment asset allocation. Asset allocation, the ratio of stocks to fixed income in your investments, is an important driver of growth, the engine that can add substantial gains to investment accounts when the market does well. More importantly, asset allocation is a source of protection, when non-stock investments are a sufficient source of funds to avoid the need to sell stock in down times. Although there are many factors that go into deciding the appropriate ratio of stock to fixed income, one way to conceptualize the decision is to think of fixed income (bonds, cash and other lower risk investments) allocation in the context of annual spending needs. For example, if you must withdraw $20,000 per year from your investments, keeping about $100,000 of the overall balance invested in fixed income will support annual withdrawals for 5 years without having to sell from stock if stock prices decline. Five years is as long as it took the US stock market to fully recover to its peak after the Great Recession of 2008-9.

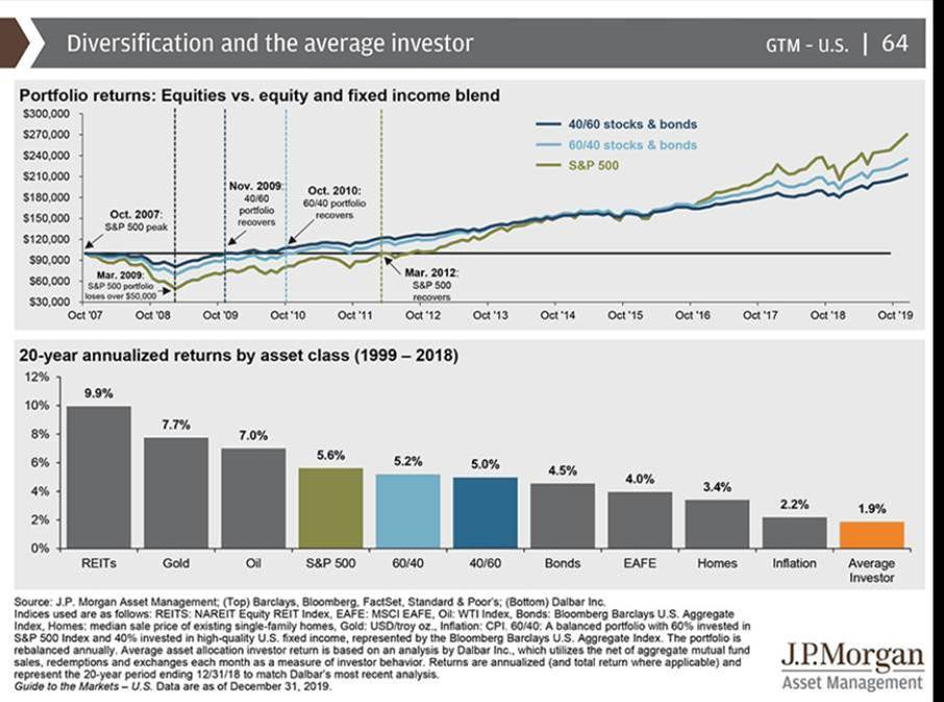

The chart below illustrates the difference in returns between the S&P 500 (the 500 largest US companies), a 60% stock / 40% bond portfolio, and a more conservative 40% stock / 60% bond portfolio. Although the S&P 500 performs well above the more conservative portfolios in good years, it does not recover as quickly in down years. After the trough of the market in October 2008, the 40/60 portfolio recovered only one year later in October 2009, whereas the S&P 500 did not recover until March of 2012 – 3 years behind the 40/60 portfolio. The 20-year annualized return further reinforces this idea by showing us that the annualized return of the S&P 500 over the last 20 years was only 0.40% higher than a 60/40 blend, and only 0.60% higher than a 40/60 blend.

A consistent, thoughtful review of your asset allocation is imperative to preserving assets for a long, prosperous retirement. Is your portfolio positioned to protect your financial future? As always, consult trusted tax and financial professionals before making important tax and financial decisions.

Samuel Financial LLC is located at 858 Washington St. Dedham, MA 02026 and can be reached at (781) 461-6886. Securities and advisory services offered through Commonwealth Financial Network, member FINRA/SIPC, a registered investment adviser. www.samuelfinancial.com.

Fixed insurance products and services offered through CES Insurance Agency or The Hanson Group.

Keep Your Eye on the SECURE Act

The SECURE (Setting Every Community Up for Retirement Enhancement) Act is a bill currently making its way through Congress. If the Act is signed into law, it will change the rules that govern Required Minimum Distributions (RMDs) made from retirement accounts after the account owner’s death.

The House of Representatives recently passed the SECURE Act with a near-unanimous bipartisan vote. The Trump administration has not taken a position on the bill. However, if the Act passes in the Senate, lobbyists who support it say they expect the president to sign it into law. Passage of the Act is currently being blocked in the Senate by Senator Ted Cruz who wants to add a provision to the bill allowing 529 college savings accounts to be used toward expenses for homeschooling.

Currently, non-spouse beneficiaries of inherited retirement accounts can stretch RMDs over their lifetimes. These distributions from inherited retirement accounts are taxable, so the longer that beneficiaries can postpone or defer them, the better.

If the SECURE Act is signed into law, non-spouse beneficiaries of retirement plans will have to withdraw the balance of the retirement account within 10 years of your death. The proportion of the retirement account distributed to the beneficiary each year within this period can vary. Exceptions have been proposed for minor and disabled children. However, once a minor child who inherits a retirement account attains the age of majority, the child would have to withdraw the balance of the account within 10 years. The Act would also impact trusts that are named as beneficiaries of retirement accounts after the owner’s death and affect distribution of retirement assets. If enacted, these new rules will begin applying to inherited IRAs in 2020 and non-IRA retirement plans in 2022.

Some strategies to keep in mind and learn more about if the act is passed are conversions of traditional IRAs to Roth IRAs, using retirement plans for charitable giving by way of qualified charitable contributions made directly from retirement plans and charitable remainder trusts funded with retirement plans and replacing the lost value of tax deferral with life insurance.

Stay tuned for more information about the SECURE Act and its impact as well as planning strategies that may mitigate the impact of this legislation if and when the Act is passed.