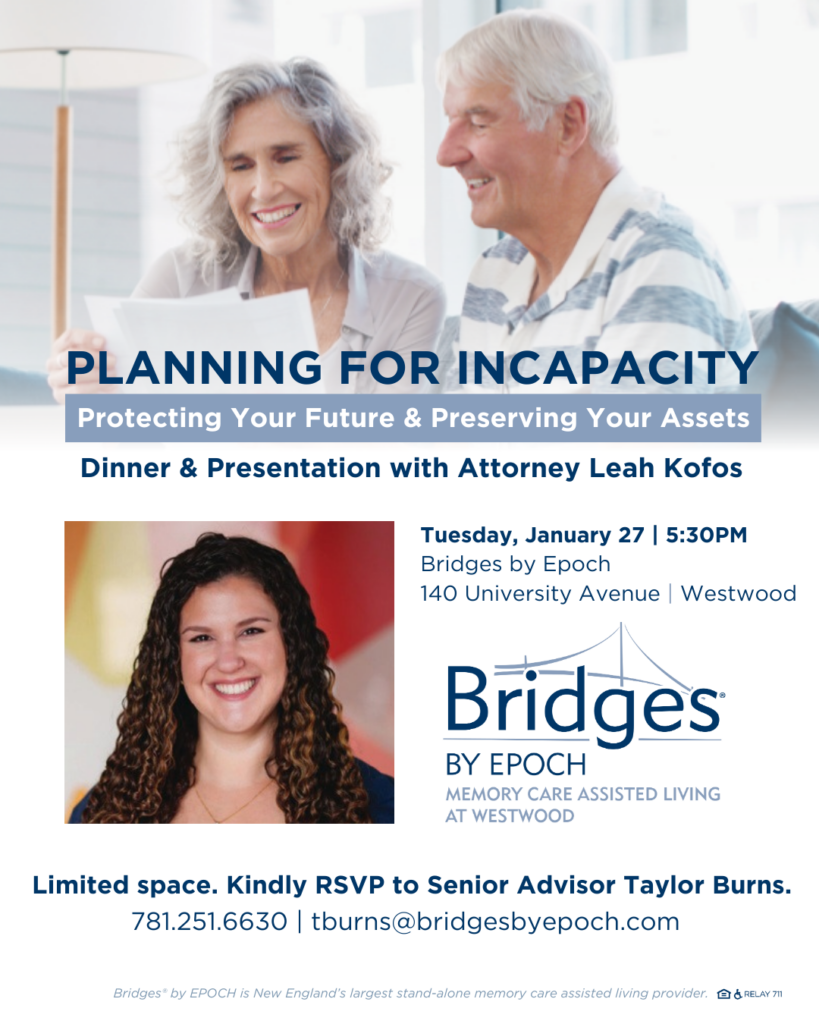

Life is unpredictable, and having a comprehensive plan in place is the most effective way to protect yourself and your loved ones. Join us for a dinner and informative presentation exploring the essential legal steps necessary to navigate potential incapacity. We will discuss how to address personal and legal challenges, strategies for asset preservation, and the importance of having a plan that ensures your wishes are honored.

Limited space. Kindly RSVP to Senior Advisor Taylor Burns.

781.251.6630 | tburns@bridgesbyepoch.com

Please note our office is closed on January 1 to celebrate the new year. Happy 2025 from all of us at SSB!

Please note our office is closed on January 1 to celebrate the new year. Happy 2025 from all of us at SSB!