I am very proud to be selected by Super Lawyers once again this year.

I am very proud to be selected by Super Lawyers once again this year.

10 Suggestions to Help You Stay on Track

Presented by Steven Joshua Samuel JD MBA AIF®

Although 2020 has been a year of unexpected changes, one routine has remained consistent: the fourth quarter means it’s time to begin organizing your finances for the new year. To help you get started, here’s a checklist of key topics to think about, including new tax and retirement considerations related to the COVID-19 pandemic.

1) Max out retirement contributions. Are you taking full advantage of your employer’s match to your workplace retirement account? If not, it’s a great time to consider increasing your contribution. If you’re already maxing out your match or your employer doesn’t offer one, boosting your contribution to an IRA could still offer tax advantages. Keep in mind that the SECURE Act repealed the maximum age for contributions to a traditional IRA, effective January 1, 2020. As long as you’ve earned income in 2020, you can contribute to a traditional IRA after age 70½—and, depending on your modified adjusted gross income (MAGI), you may be able to deduct the contribution.

2) Refocus on your goals. Did you set savings goals for 2020? Evaluate how you did and set realistic goals for next year. If you’re off track, we’d be happy to help you develop a financial plan.

3) Spend flexible spending account (FSA) dollars. If you have an FSA, note that the Internal Revenue Service (IRS) relaxed certain “use or lose” rules this year because of the pandemic. Employers can modify plans through the end of this year to allow employees to “spend down” unused FSA funds on any health care expense incurred in 2020—and let you carry over $550 to the 2021 plan year. If you don’t have an FSA, you may want to calculate your qualifying health care costs to see if establishing one for 2021 makes sense.

4) Manage your marginal tax rate. If you’re on the threshold of a tax bracket, you may be able to put yourself in the lower bracket by deferring some of your income to 2021. Accelerating deductions such as medical expenses or charitable donations into 2020 (rather than paying for deductible items in 2021) may have the same effect.

Here are a few key 2020 tax thresholds to keep in mind:

5) Rebalance your portfolio. Reviewing your capital gains and losses may reveal tax planning opportunities; for example, you may be able to harvest losses to offset capital gains.

6) Make charitable gifts. Donating to charity is another good strategy worth exploring to reduce taxable income—and help a worthy cause. Take a look at various gifting alternatives, including donor-advised funds.

7) Form a strategy for stock options. If you hold stock options, be sure to develop a strategy for managing current and future income. Consider the timing of a nonqualified stock option exercise based on your estimated tax picture. Does it make sense to avoid accelerating income into the current tax year or to defer income to future years? If you’re considering exercising incentive stock options before year-end, don’t forget to have your tax advisor prepare an alternative minimum tax projection to see if there’s any tax benefit to waiting until January.

8) Plan for estimated taxes and required minimum distributions (RMDs). Both the SECURE and CARES acts affect 2020 tax planning and RMDs. Under the SECURE Act, if you reached age 70½ after January 1, 2020, you can now wait until you turn 72 to start taking RMDs—and the CARES Act waived RMDs for 2020. If you took a coronavirus-related distribution (CRD) from a retirement plan in 2020, you’ll need to elect on your 2020 income tax return how you plan to pay taxes associated with the CRD. You can choose to repay the CRD, pay income tax related to the CRD in 2020, or pay the tax liability over a three-year period. But remember: once you elect a strategy, you can’t change it. Also, if you took a 401(k) loan after March 27, 2020, you’ll need to establish a repayment plan and confirm the amount of accrued interest.

9) Adjust your withholding. If you think you may be subject to an estimated tax penalty, consider asking your employer (via Form W-4) to increase your withholding for the remainder of the year to cover the shortfall. The biggest advantage of this is that withholding is considered to be paid evenly throughout the year instead of when the dollars are actually taken from your paycheck. You can also use this strategy to make up for low or missing quarterly estimated tax payments. If you collected unemployment in 2020, remember that any benefits you received are subject to federal income tax. Taxes at the state level vary, and not all states tax unemployment benefits. If you received unemployment benefits and did not have taxes withheld, you may need to plan for owing taxes when you file your 2020 return.

10) Review your estate documents. Review and update your estate plan on an ongoing basis to make sure it stays in tune with your goals and accounts for any life changes or other circumstances. Take time to:

Be Proactive and Get Professional Advice

Remember to get a jump on planning now so you don’t find yourself scrambling at year-end. Although this list offers a good starting point, you may have unique planning concerns. As you get ready for the year ahead, please feel free to reach out to us to talk through the issues and deadlines that are most relevant to you.

This material has been provided for general informational purposes only and does not constitute either tax or legal advice. Although we go to great lengths to make sure our information is accurate and useful, we recommend you consult a tax preparer, professional tax advisor, or lawyer.

Samuel Financial LLC is located at 858 Washington St. Dedham, MA 02026 and can be reached at (781) 461-6886. Securities and advisory services offered through Commonwealth Financial Network ®, member FINRA/SIPC, a registered investment adviser. www.samuelfinancial.com.

Legal services offered through Samuel, Sayward & Baler, LLC are separate and unrelated to Commonwealth.

We would like to take this opportunity to acknowledge the passing in September of two champions of equality and justice.

Chief Justice Ralph Gants was the Chief Justice of the Massachusetts Supreme Judicial Court. In that role he not only presided over the highest appellate court in the state which decides criminal and civil matters appealed from other state courts, but was also the chief administrative justice of the Massachusetts court system. It was in that role that he touched every attorney in Massachusetts, inspiring us to do good work, while also truly caring about the well-being of all Massachusetts attorneys who labor in a profession with increasingly high levels of stress and related challenges. Most recently, Justice Gants led the Courts through the unprecedented COVID shutdown, when physical access to the Courts was limited, with equal concern for the public seeking access to the Courts for everything from adoptions to criminal trials, the attorneys and Court personnel. Just prior to his death researchers at Harvard Law School released a report commissioned by Justice Gants looking at racial disparities in the criminal justice system, with an eye towards working to ensure equal justice for all.

Justice Gants’ respect and compassion for his fellow attorneys was apparent in many ways – in how he addressed attorneys from the bench, in how he encouraged us to carry on in his messages during the COVID pandemic, and in how, on a snowy morning years ago, he left his chambers to venture into the hallway of the courthouse after hearing that an attorney had slipped and fallen on the ice outside, to check on her and make sure she was comfortable proceeding with her appearance before the Court. He will be truly missed.

Justice Ruth Bader Ginsburg needs no introduction, and has been a prominent figure in our national legal landscape for decades. Her personal struggles against discrimination as a woman and a mother are well-known, and although those experiences happened only decades ago, are gratefully hard to imagine today. That being said, the legal profession and many others are by no means completely free of the discrimination and inequality that Justice Ginsburg faced. It was her work to ensure that future generations did not have to face the obstacles she did to which we here at Samuel, Sayward & Baler, a firm of mostly women attorneys and many mothers, owe our careers, and we are eternally grateful. As Rabbi Lauren Holtzblatt said when eulogizing Justice Ginsburg in the memorial service at the United States Supreme Court:

“To be born into a world that does not see you, that does not believe in your potential, that does not give you a path for opportunity or a clear path for education — and despite this, to be able to see beyond the world you are in, to imagine that something can be different: that is the job of a prophet. And it is the rare prophet who not only imagines a new world, but also makes that new world a reality in her lifetime.”

For more about Justice Ginsberg, we recommend the eloquent tributes to Justice Ginsburg written by the remaining justices of the Supreme Court.

We will forever be inspired by these two great lawyers and justices.

As if the passage of the SECURE Act on January 1st of this year did not create enough upheaval in the world of qualified retirement plans, along came the “Coronavirus Aid, Relief and Economic Security” Act (the CARES Act) on March 27, 2020 and added even more. The CARES Act upends the fundamental rules for who must, and who may, take distributions from qualified retirement plans such as IRAs, 401ks, 403(b)s and 457 plans in 2020.

A Refresher on Qualified Retirement Plans

Qualified retirement plans such as 401ks and IRAs allow people to set aside some of their earned income for their retirement in a tax-favored way by deferring the income tax due on the funds contributed to the plan until such time as the funds are withdrawn. Roth plans work the opposite way – they are funded with post-tax dollars but no tax is owed on amounts withdrawn. In both types of qualified retirement plans, the funds in the plan grow tax-free.

As the purpose of these plans is to encourage people to save for retirement, the law discourages withdrawals prior to age 59.5 by imposing a 10% penalty on amounts taken out of the plan before reaching that age.

On the flip side, since the government wants to collect the tax on these monies eventually, the rules governing qualified retirement plans require that a certain amount be withdrawn each year once the owner reaches age 70.5 (age 72 beginning in 2020 thanks to the SECURE Act). The amount required to be withdrawn each year from a traditional retirement plan is the Required Minimum Distribution (RMD), sometimes called the Minimum Required Distribution (MRD). (Note that individuals who fund a Roth IRA or 401K are not required to take withdrawals during their lifetimes.) Whatever you call it, this amount MUST be withdrawn from the plan and the owner must pay income tax on the amount withdrawn. In fact, the government is so adamant about this withdrawal that the law imposes a 50% penalty if someone fails to take the full amount of their RMD in any one year. But not in 2020!

Individuals Required to Take Minimum Distributions are NOT Required to do so in 2020

The CARES Act eliminates the requirement that a person who has reached his required beginning date (i.e. age 70.5 before January 1, 2020) take an RMD in 2020. For people with large retirement plans who do not need their RMD to pay their expenses, this is a tremendous benefit. Not only will the amount of the RMD remain in the qualified retirement plan and continue to grow tax free, but the income tax due on the distribution is avoided. For example, if the RMD on a $1 million IRA is $50,000, not having to take those funds might save $10,000 in tax (15% federal and 5% in Massachusetts). This is not a deferral of the tax; this is a complete avoidance of it.

Individuals who took a Distribution in 2020 but Wished They hadn’t may put it back

Not only does CARES allow people to skip their RMD for 2020, but it allows people who took their RMD out of their IRAs earlier in the year to return the funds and avoid the tax. However, you must return the funds to your IRA by August 31, 2020. If you are in this situation, contact your tax advisor or the custodian of your retirement account as soon as possible to make sure you comply with the rules for returning the funds before the deadline.

Individuals who would have been Penalized for Taking Distributions from Qualified Retirement Plans may be able to do so without Penalty in 2020

Under CARES, if a person under the age of 59.5 is a ‘qualified individual’ he may withdraw up to $100,000 from qualified retirement plans in 2020 without incurring the 10% penalty. In addition, a qualified individual may spread the tax due on the distribution over a 3-year period. Alternatively, a qualified individual may re-pay the distribution to the plan within three years and never pay the tax on the distribution – kind-of like a tax-free loan from yourself.

Under CARES, a ‘qualified individual’ eligible for this favorable treatment, is:

Either a person who is diagnosed with COVID-19, or whose spouse or dependent is diagnosed with COVID-19;

Or,

Someone who experiences ‘adverse financial circumstances’ (or whose spouse or household member does) as a result of the pandemic.

The Act includes a number of examples under which ‘adverse financial circumstances’ may occur (being laid off or furloughed, losing child care, being quarantined, or experiencing a reduction in pay) and does not otherwise define adverse circumstances.

The provisions of the CARES Act applicable to qualified retirement accounts can provide significant financial benefit for people who find themselves in either of these circumstances – over age 70.5 and not in need of the annual RMD, or under age 59.5 and in need of funds. The above is a summary of these rules and of course the devil is in the details. If you want to learn more about your options under CARES, reach out to your tax or financial advisor to learn how the specific provisions of the Act apply to your situation.

Congratulations! You’ve been named as a Trustee by a loving family member. Now what?

Family members are often named to serve as Trustees without any explanation of their role and duties and sometimes without any notice. It is no surprise that family member Trustees make mistakes, some of which become lawsuits. Here’s an outline of the Trustee’s role and responsibilities and some common mistakes family member Trustees make.

Trustee Role and Responsibilities

Family estate plans often include Trusts because Trusts can accomplish many family goals. Real estate and other assets owned by a Trust avoid probate, the costly, time consuming and public process of carrying out instructions in a Will. Trusts can reduce estate taxes, achieve charitable goals, provide for young children or family members with special needs and accomplish other important purposes for families.

Trustees, the people named in Trusts to manage the affairs of the Trust, have administrative, investment and distribution roles. Trustee administrative roles include keeping records of what the Trust owns and reporting on the condition of Trust assets to the Trust beneficiaries, as well as filing tax returns for the Trust. Trustee investment duties include managing investments directly or choosing and supervising investment advisors. A Trustee’s distribution role is to carry out the instructions in the Trust about what each beneficiary is entitled to receive and when the beneficiary is entitled to receive it.

Common Misunderstandings and Mistakes

Baby boomers are anticipated to transfer close to $70 TRILLION to the next generation. Given the complex nature of Trustee responsibilities, it is no surprise that lawsuits between family members are increasing, often caused by misunderstandings and mistakes by inexperienced family member Trustees. Here are some examples.

Misunderstanding Fiduciary Responsibilities

By law, Trustees have fiduciary level responsibility to beneficiaries of Trusts, not to the creators of Trusts. Fiduciary level responsibility means the Trustee must make decisions based on what is best for the beneficiaries; and, all Trustee conflicts must be disclosed and addressed in a fair way. This can be very tricky when a Trustee is also one of the beneficiaries.

When investments don’t produce enough money to accomplish Trust instructions to provide education or other costs for every one of several beneficiaries, carrying out fiduciary responsibility can challenge even experienced professional Trustees. And, another challenging situation occurs when investments produce much more money than was expected and potentially put a great deal of money in the hands of very young persons.

Investment Supervision Misunderstandings

Trusts can own life insurance, real estate, stocks, bonds, mutual funds and virtually any other assets. Trustees have a duty to supervise the performance of all investments, not simply be a record keeper and that requires knowledge and experience. For example, life insurance policies owned by Trusts, especially policies with cash value, should be reviewed annually, with updated performance information obtained from the insurance company. Stock, bonds and similar investments need even more frequent attention from Trustees. Trustees must be able to carefully select investment advisors as well as supervise the advisors and be well informed about laws and Trust instructions that guide or limit Trust investments.

Administrative Misunderstandings

Record keeping and taxation of Trust owned property and investments are very different than the same tasks for individually owned assets. For example, Trust income reaches the highest tax bracket (37%) for income over $ 12,950 compared with an individual taxpayer’s income that reaches the 37% bracket at $ 500,000. When Trust income is distributed to individual beneficiaries, the income is instead taxable at the individual’s rate.

Payment of premium for Trust owned life insurance involves more than sending a check to an insurance company. The payments are usually funded by gifts to the Trust that have to be documented in a particular way and a mistake can void the tax benefit of the Trust.

When Trustees don’t provide periodic accountings to beneficiaries, the result can be more than hurt feelings of other family members. The same is true when Trustees pay themselves fees for their work as Trustees, depending on whether fees are authorized by the Trust and whether the fees are reasonable in relation to the work.

Approaches to Avoiding Trustee Misunderstandings

Future misunderstandings between family member Trustees and beneficiaries are not easily foreseen. Changes in families through marriage, divorce or unexpected financial reverses or gains can upend even the most stable, close family relationships.

People who intend to name family members as Trustees, can help avoid future misunderstandings by a range of methods. A family member’s interest and willingness to learn about Trustee roles and duties may be an important clue to whether being a Trustee is a good fit for that person. Written materials about Trustee roles and duties are not hard to find and the family’s current legal, tax and financial advisors are another source of education. Selecting a professional Trustee is another choice some families may prefer. Consulting the family estate planning attorney and other close professional advisors is a good place to start in searching for good choices for Trustees.

Samuel Financial LLC is located at 858 Washington St. Dedham, MA 02026 and can be reached at (781) 461-6886. Securities and advisory services offered through Commonwealth Financial Network ®, member FINRA/SIPC, a registered investment adviser. www.samuelfinancial.com.

Legal services offered through Samuel, Sayward & Baler, LLC are separate and unrelated to Commonwealth.

From your Samuel Financial LLC Team

We hope you are staying safe and finding ways to make the best of your time at home during the COVID-19 public health emergency. Previously, we’ve sent an outline of the government stimulus programs to ensure you are aware of the financial help available to both individuals (unemployment, including for self-employed persons) and forgivable loans for companies (Paychecks Protection Program and others). The government’s programs also include waiving the Required Minimum Distributions from all individual and company retirement accounts and extensions of time to repay loans from company retirement plans, for just two more examples of the help available.

The government’s assistance programs are new and sometimes not clear enough. For example, many self-employed persons are not aware that they are now permitted to apply for unemployment and receive $600 per week, in addition to the amount paid by Massachusetts or other states of residence, for many weeks. If you have a question about whether you are eligible for government programs, we’d be happy to hear from you and help resolve your questions.

Courtesy of colleagues at Nationwide and our own staff, we are sharing some website resources that may help you stay well stocked, safe and maybe even entertained:

Grocery Delivery Services:

Wal-Mart Grocery Delivery https://grocery.walmart.com/

Amazon Prime Now Grocery Delivery https://primenow.amazon.com/

Food Delivery Services:

Uber Eats https://www.ubereats.com/

DoorDash https://www.doordash.com/

GrubHub https://www.grubhub.com/

Postmates https://postmates.com/

CDC’s Official Website for COVID-19 Updates:

https://www.cdc.gov/coronavirus/2019-ncov/index.html

Massachusetts’s Official Website for COVID-19 Updates:

https://www.mass.gov/resource/information-on-the-outbreak-of-coronavirus-disease-2019-covid-19

Nationwide Care Concierge for Annuity Contract Owners, Spouses, Children, Parents and Parents in Law

https://nationwidefinancial.com/resources/support/annuities/nationwide-care-concierge

https://members.healthadvocate.com/Home/Index

Tips for Working at Home:

https://www.npr.org/2020/03/15/815549926/8-tips-to-make-working-from-home-work-for-you

https://www.businessinsider.com/how-to-work-from-home-during-the-coronavirus-outbreak-2020-3

https://www.cbsnews.com/news/coronavirus-pandemic-tips-for-working-from-home/

Ideas and Free Educational Materials for Kids at Home:

Scholastic’s Free Learn at Home

https://classroommagazines.scholastic.com/support/learnathome.html

Khan Academy Free Learning

Crash Course YouTube Channel

Best wishes from Samuel Financial LLC

Steve Samuel, Chad Gutner, Nancy Mann, Kevin Cotton, Veronica Garzone, Sarah Newell and Stephanie Gallegos

Samuel Financial LLC is located at 858 Washington Street, Dedham, MA 02026 and can be reached at 781.461.6886. Securities and advisory services offered through Commonwealth Financial Network, member FINRA/SIPC, a registered investment adviser. Fixed Insurance products and services offered through CES Insurance Agency.

by SSB

While this period of quarantine is the perfect opportunity to clean out your attic, catch up on your Netflix queue, or get in shape, this is also the time to make sure you have the appropriate legal documents in place in the event that you are not able to make or communicate your health care decisions. These documents include a Health Care Proxy and HIPAA Authorization and many choose to also execute a Living Will

Health Care Proxy: A Health Care Proxy is the document by which you appoint a health care agent – the person who will make health care decisions for you if you are not able to make them for yourself. If you already have executed a Health Care Proxy, take a moment to locate it, ensure that the agent you named is still appropriate, and distribute copies (if you haven’t already) to your agent, your primary care doctor and perhaps your family members. Most of us usually have our cell phones close by so it’s a good idea to scan a copy of your health care proxy and save it on your phone.

We also recommend that you affix a copy of your Health Care Proxy, emergency contact information and health insurance information to the side of your refrigerator. EMTs are trained to look for emergency information there.

HIPAA Authorization: It is also important to execute a HIPAA Authorization. The Health Insurance Portability and Accountability Act (HIPAA) was enacted in 1996 to help ensure the privacy of your medical records. A HIPAA Authorization is a document that authorizes your health care agent and any family members or friends you list to talk to your medical professionals and view your medical records. Remember that once your teenager reaches age 18, they will need to execute a HIPAA Authorization authorizing you to speak with their doctors and view their medical records. The mere fact that you are mom/dad/guardian is not sufficient.

Living Will: Additionally, you may wish to sign a Living Will. While Living Wills are not legally binding in Massachusetts, they provide guidance to your doctors and health care agent about your wishes regarding end of life care in the event that you have a terminal condition or are in a persistent vegetative state.

Other practical suggestions during this time of Coronavirus:

If you have a family member sick at home and at risk of being hospitalized it’s a good idea to have an emergency bag packed, since visitors are not being allowed in to the hospital. Things to include in the bag: *

These are uncertain times right now, but ensuring that your health care documents are up to date can provide some peace of mind for you and your loved ones. If you wish to create or update your health care proxy, please contact our office. We are working remotely but are able to speak with you over the phone or via Zoom and will meet you in the office parking lot to execute your documents. One silver lining in all of this – we are waiving the $400 fee we customarily charge our clients for initial estate planning meetings if you make an appointment in the month of April.

Please do not hesitate to reach out with any questions. We are happy to speak with you and to do what we can to ease your mind during this difficult time.

*With thanks and credit to Peter T. Clark Esquire of Mansfield, Massachusetts for compiling and sharing this great list!

The Dedham firm of Samuel, Sayward & Baler LLC which focuses on advising its clients in the areas of estate planning, estate settlement and elder law matters. This article is not intended to provide legal advice or create or imply an attorney-client relationship. No information contained herein is a substitute for a personal consultation with an attorney. For more information visit www.ssbllc.com or call 781/461-1020.

March, 2020

© 2020 Samuel, Sayward & Baler LLC

Dear Clients, Colleagues and Friends,

We hope this finds you all well and safe! As promised, we want to give you an update on our plans in light of Governor Baker’s emergency order of this morning.

We are and will continue to be “open” for business as we are well-equipped to work remotely, including meeting with clients by phone or video conference. However, in compliance with the Governor’s order, we closed our physical office beginning Tuesday, March 24 at noon until Monday, May 4th (assuming we are permitted to re-open at that time), which means we will not be able to physically meet with clients to sign documents during that time.

We want you to know that we are here to help you. You are welcome to reach out to any of us by phone or email at any time. If you would like to schedule a time to speak or video conference with us, please email Jennifer Poles (poles@ssbllc.com) or Lynne Abe (abe@ssbllc.com) or call the office at 781-461-1020.

In other news, Attorney Abigail Poole of our office has been involved with proposed legislation, supported by hundreds of attorneys statewide, to allow attorneys who are notaries to conduct meetings to sign documents in a virtual manner via video conference. Keep an eye out for information about how you can support this effort by contacting your legislators.

We will continue to keep you updated as the situation evolves, and continue to wish you and your family health and safety during these uncertain times.

Suzanne R. Sayward

Maria C. Baler

Julia K. Abbott

Abigail V. Poole

By Sarah Newell, CFP® and Steven Joshua Samuel, JD, MBA, AIF®

With average life expectancies increasing, retirees need strategies that address a broad array of uncertainties that arise during retirements that may last three or more decades. Retirees’ top concerns elicited in the 2018 American institute of CPAs (AICPA) Personal Financial Trends Survey included:

77% Health Care Costs

53% Market Fluctuation

50% Other Unexpected Costs

42% Lifestyle Expenses

22% Being a Burden on Relatives

The AICPA survey also reported that CPAs are seeing increases (from five years ago) in the number of clients who experience long term care impact on finances ( 57%), more clients taking care of aging relatives ( 50%); and in the number of clients affected by diminished capacity of a family member ( 45%).

A change in the law in 2020 offers a bit of help to retirees. However, the best approach is still self-help through identifying specific financial goals and developing a comprehensive approach that includes investment strategy, taxes and legal documents. Here are some thoughts about those subjects.

The SECURE Act of 2020

Although legislation alone cannot solve retiree’s major concerns, the SECURE ACT offers some help. The SECURE Act went into effect on January 1, 2020 and makes significant changes to retirement planning. Some of the key changes that affect retirees include:

Age Limit Removed for IRA Contributions

Until 2020, people over 70.5 years of age could no longer contribute to IRA accounts. Beginning in 2020, persons of any age may contribute to an IRA as along that they have income from employment. Note that contributions to company retirement plans have always been permitted by any person eligible for the plan and that remains the law.

Required Minimum Distribution ( RMD) extended to start at age 72

Until 2020, people reaching age 70.5 had to begin withdrawing money from all their retirement accounts. The SECURE act extends the RMD requirement to begin at age 72 for people who had not reached 70.5 before 2020. People who reached 70.5 before 2020 must continue to take RMDs even before age 72.

Incentives are Offered for Small Businesses to Offer Retirement Plans

Elimination of Stretch IRAs

First, a not helpful provision of the SECURE Act requires non-spouse inheritors of IRAs to deplete the entire account within 10 years of inheritance. Previously, all heirs were permitted to stretch withdrawals to the full length of their lifetimes. Second and fortunately, spouses who inherit are permitted to continue to stretch their withdrawals and there are also partial exceptions to the harsh new rule for minor children and persons with disabilities.

The SECURE Act of 2020 makes saving for retirement and tax and estate planning for retirees better in some respects but somewhat more complex. This is a good time to check in with trusted financial and legal advisors. In the meantime, here are some additional thoughts about how successful retirees cope with the uncertainties of retirement.

How Successful Retirees Cope with Retirement’s Uncertainties

Most successful retirees start by carefully identifying their spending goals and developing a reasonably good estimate of their non-discretionary expenses, the basic spending they cannot avoid. Non-discretionary spending means the cost of rent or mortgage and taxes, utilities, transportation costs, meals; and, other lifestyle basics we all seem to have to need, such as our phone and cable. Successful retirees also set some parameters on their discretionary spending on vacations, gifts to family and similar beyond the basics “wants.” Equally important, successful retirees periodically assess potential future expenses such as home and car maintenance and address these with specific savings; and, they address big risks such as health needs with insurance and legal strategies. Of course, successful retirees also accumulate retirement savings and match the level of savings with their level of desired combined total spending, or reduce their spending if the numbers don’t match.

Identifying spending goals and having substantial retirement savings isn’t enough, though. Even substantial savings can be damaged by market losses, especially during retirement, when retirees are withdrawing money for living expenses. Retirees and people saving for retirement must reconcile the need for their investments to grow to keep up with inevitably rising costs versus the need to avoid investment market losses. The fear of failing to successfully reconcile these two goals is made more intense by the memory of the nearly 50% stock market declines in the early 2000s and again in 2008-9.

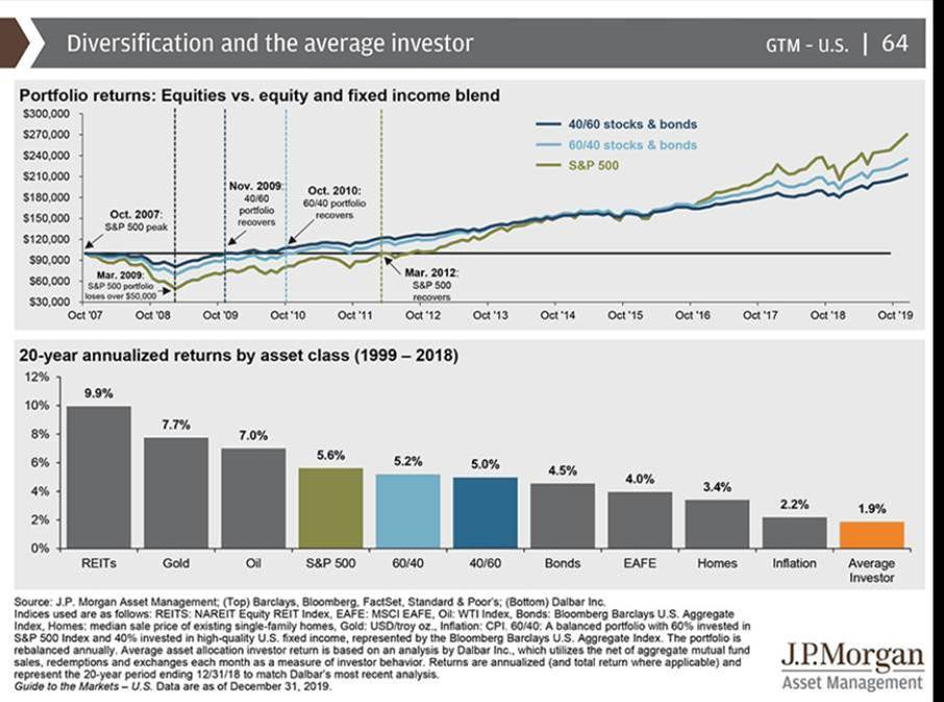

A powerful way some successful retirees reconcile the competing needs for investment growth and avoiding market losses is by regularly revisiting their investment asset allocation. Asset allocation, the ratio of stocks to fixed income in your investments, is an important driver of growth, the engine that can add substantial gains to investment accounts when the market does well. More importantly, asset allocation is a source of protection, when non-stock investments are a sufficient source of funds to avoid the need to sell stock in down times. Although there are many factors that go into deciding the appropriate ratio of stock to fixed income, one way to conceptualize the decision is to think of fixed income (bonds, cash and other lower risk investments) allocation in the context of annual spending needs. For example, if you must withdraw $20,000 per year from your investments, keeping about $100,000 of the overall balance invested in fixed income will support annual withdrawals for 5 years without having to sell from stock if stock prices decline. Five years is as long as it took the US stock market to fully recover to its peak after the Great Recession of 2008-9.

The chart below illustrates the difference in returns between the S&P 500 (the 500 largest US companies), a 60% stock / 40% bond portfolio, and a more conservative 40% stock / 60% bond portfolio. Although the S&P 500 performs well above the more conservative portfolios in good years, it does not recover as quickly in down years. After the trough of the market in October 2008, the 40/60 portfolio recovered only one year later in October 2009, whereas the S&P 500 did not recover until March of 2012 – 3 years behind the 40/60 portfolio. The 20-year annualized return further reinforces this idea by showing us that the annualized return of the S&P 500 over the last 20 years was only 0.40% higher than a 60/40 blend, and only 0.60% higher than a 40/60 blend.

A consistent, thoughtful review of your asset allocation is imperative to preserving assets for a long, prosperous retirement. Is your portfolio positioned to protect your financial future? As always, consult trusted tax and financial professionals before making important tax and financial decisions.

Samuel Financial LLC is located at 858 Washington St. Dedham, MA 02026 and can be reached at (781) 461-6886. Securities and advisory services offered through Commonwealth Financial Network, member FINRA/SIPC, a registered investment adviser. www.samuelfinancial.com.

Fixed insurance products and services offered through CES Insurance Agency or The Hanson Group.

We are often asked about the tax rules around gift-giving, especially as the end of the year approaches. These tax rules are governed by the federal gift and estate tax system, which is wholly separate from the income tax system. There is no Massachusetts gift tax.

If you give a gift, the money you give is not income taxable to the recipient, nor is the gift tax-deductible by you (the person who makes the gift, who we’ll call the “donor”), unless it is made to a qualified charity.

Federal gift tax, if any, is paid by the donor, not by the recipient. For federal gift and estate tax purposes, under current law every US citizen has a combined $11.4 million exemption (in 2019) from gift and estate tax. This means that each person can give up to $11.4 million to others, either during their lifetime or at death, without paying any federal gift or estate tax. A gift tax is payable only after the donor has made combined lifetime and death time gifts of more than $11.4 million.

In addition, certain gifts are exempt from the gift tax. Exempt gifts include:

These exempt gifts do not require the donor to file a federal gift tax return. If a donor makes a non-exempt gift, a federal gift tax return must be filed, even if no gift tax is payable, to track how much of the donor’s gift and estate tax exemption has been used.

The gift tax is complicated, but for most people who want to make gifts to children or grandchildren, the gift tax will not be an issue. If you wish to make a non-exempt gift, it is best to consult with your estate planning attorney and accountant before making the gift so that issues such as timing, and estate, gift and capital gain tax implications can be thoughtfully considered prior to making the gift.

Please note we only are only able to serve clients with legal matters pertaining to Massachusetts.

Samuel, Sayward & Baler LLC

858 Washington Street, Suite 202

Dedham, MA 02026

781-461-1020 (phone)

781-461-0916 (fax)

©2026 Samuel, Sayward & Baler LLP. All Rights Reserved. The information presented on this website should not be construed to provide legal advice, nor does it constitute the formation of an attorney/client relationship. Read the disclaimer.