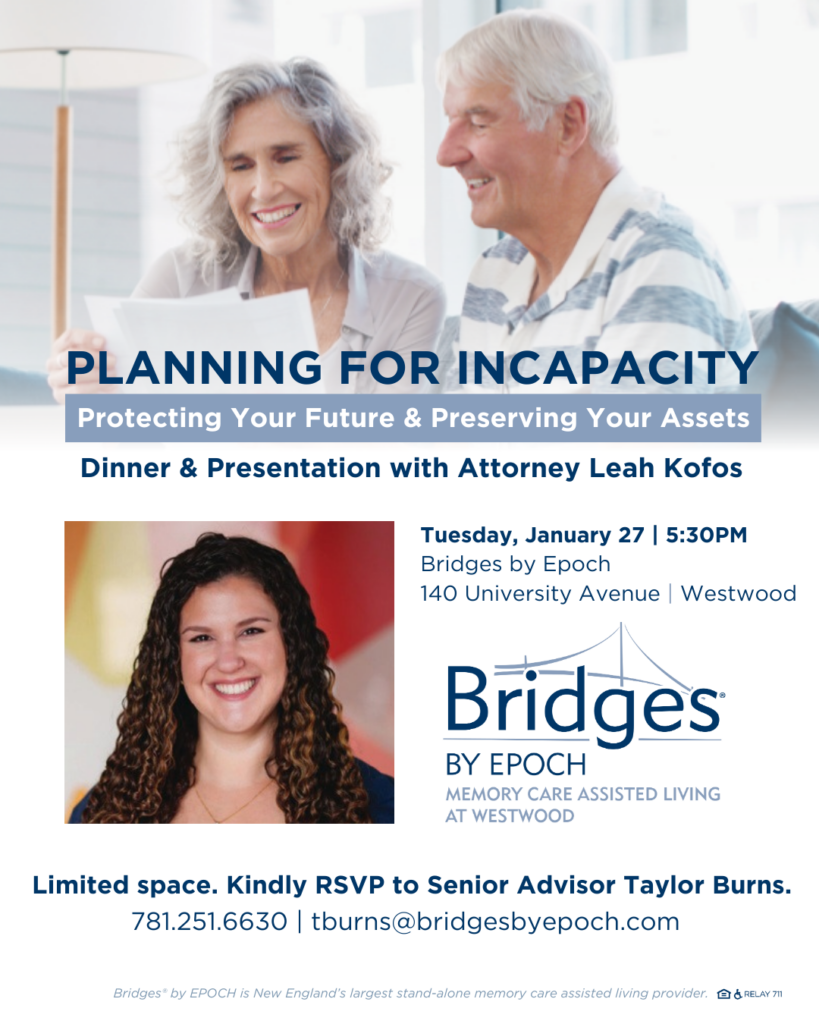

Life is unpredictable, and having a comprehensive plan in place is the most effective way to protect yourself and your loved ones. Join us for a dinner and informative presentation exploring the essential legal steps necessary to navigate potential incapacity. We will discuss how to address personal and legal challenges, strategies for asset preservation, and the importance of having a plan that ensures your wishes are honored.

Limited space. Kindly RSVP to Senior Advisor Taylor Burns.

781.251.6630 | tburns@bridgesbyepoch.com

If you are following along with the irrevocable trust saga, you know that on January 5, 2017, the Supreme Judicial Court heard oral argument on two irrevocable income only trusts where the MassHealth applicant placed his or her primary residence into the trust prior to applying for nursing home benefits. It was incredible to watch the attorneys argue their opposing sides before the panel of elite judges at One Pemberton Square. One of my clients lovingly called the hearing “the Superbowl of Elder Law” (but I think he was making fun of me). With the fate of irrevocable trusts literally hanging in the balance, what other options do we as elder law attorneys have to advise our clients on how to protect their primary residence from the placement and collection of a MassHealth lien? Since the home is often our clients’ most valuable asset, preserving the home from a MassHealth lien often feels like the million dollar question. Here are some options:

If you are following along with the irrevocable trust saga, you know that on January 5, 2017, the Supreme Judicial Court heard oral argument on two irrevocable income only trusts where the MassHealth applicant placed his or her primary residence into the trust prior to applying for nursing home benefits. It was incredible to watch the attorneys argue their opposing sides before the panel of elite judges at One Pemberton Square. One of my clients lovingly called the hearing “the Superbowl of Elder Law” (but I think he was making fun of me). With the fate of irrevocable trusts literally hanging in the balance, what other options do we as elder law attorneys have to advise our clients on how to protect their primary residence from the placement and collection of a MassHealth lien? Since the home is often our clients’ most valuable asset, preserving the home from a MassHealth lien often feels like the million dollar question. Here are some options: